Search for yield drives EM currencies higher

In last week’s article It’s Hip to be in TIP, we noted surging inflows into emerging market equity ETFs have led to the strong performance of EM stock markets this year, particularly the TIP (Thailand, Indonesia and Philippines). Central to this thesis is the sharp recovery in emerging market currencies.

After a rough 2015 and a brutal start in 2016 which left investors reminiscing the 1997 Asian currency crisis, EM currencies have since recovered sharply. The US dollar stabilized against major currencies and commodity prices rebounded from multi-year lows. Moreover, in a world where sub-zero rates is now the new normal, global investors have turned to emerging markets in search for yield, driving EM currencies and other EM assets higher.

The inflection point

Recall that in February we wrote several articles pointing to signs of an inflection point in EM currencies.

“In the face of various risks to global growth, central banks retaliated with powerful statements and showed the dogged determination to achieve their policy objectives. Doing this has restored a lot of the confidence in the markets, especially in the battered EM indices and currencies.” (see Central Banks Strike Back, Feb. 1).

“While we have been bullish on the US dollar since 2013, we are now seeing early indications the US dollar may be changing its character. Note that during the past two weeks, the US dollar index fell 3.6 percent, its sharpest two-week decline since the bull-run started in 2011. The yen got off to its best two-week run since 2008, while crude oil posted its biggest one-day gain in seven years.” (see Philippines, A Sanctuary amidst Global Turmoil, Feb. 15).

“After Yellen’s testimony pointing to a more gradual tightening, the dollar fell more than four percent from its end-January levels… With the pause in dollar strength, most emerging market and commodity-linked currencies rallied strongly, helping the recovery in global equities.” – (see The Bounce, Feb. 22).

By March, this inflection point in EM currencies was validated when it was clear the Fed cannot raise rates as previously planned.

“The Fed’s statement that it is concerned of increased volatility in the global financial markets, and indications of a slower pace of Fed hikes this year halted the US dollar momentum. These statements effectively lessened the policy divergence theme which had supported the dollar higher the past two years.” (see Peso stabilizes below 47, March 21).

The new normal

The ultra-loose monetary policy of global central banks which has pushed yields to ever lower levels has now become the “new normal.” Today, more than $10 trillion in global sovereign debt are yielding negative interest rates. Together with the improved outlook on China and the stability of commodity prices this year, global investors hungry for yield have turned to emerging markets, driving EM currencies higher.

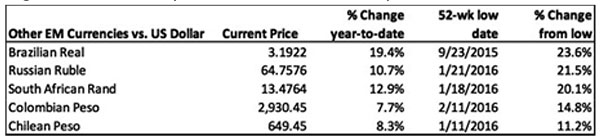

Commodity-based EM currencies

Leading the way for EM currencies are the Brazilian real, Russian ruble and South African rand. These are currencies of countries greatly benefiting from improved prices of oil and other resources this year. The Brazilian real has appreciated by 23.6 percent since its low in September 2015 against the US dollar. Meanwhile, the ruble and the rand have strengthened more than 20 percent from their lows in January.

Source: Bloomberg, Wealth Securities Research

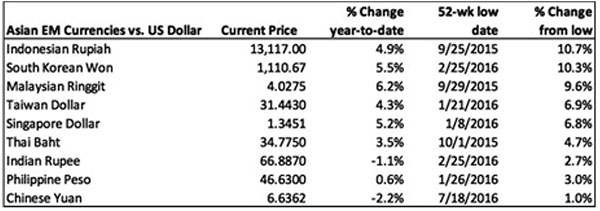

Asian EM currencies

In Asia, the Indonesian rupiah and Malaysian ringgit, which are also highly sensitive to oil and commodity prices, have rallied 10.7 percent and 9.6 percent from their lows registered last September 2015.

The South Korean won, the Taiwan dollar and the Singapore dollar have likewise strengthened significantly as pressures from erstwhile weak Japanese yen have eased this year. The Japanese yen has recovered by 15.7 percent year-to-date after three straight years of decline from 2013 to 2015.

Source: Bloomberg, Wealth Securities Research

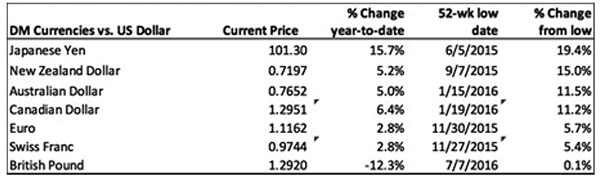

Developed market currencies

Apart from the yen, commodity-sensitive DM currencies such as the New Zealand dollar, Australian dollar and the Canadian dollar have also appreciated notably this year. Only the Euro and the Swiss Franc were slightly changed against the greenback, while the British pound suffered a sharp decline following the Brexit decision.

Source: Bloomberg, Wealth Securities Research

Goldilocks peso

Meanwhile, the peso remains very stable as it has been throughout the year. As we have noted in a previous article, the peso has been less volatile in terms of the extent and direction of its price movement compared to other Asian currencies the past year. It has also maintained its price fluctuation in a tight range (see Not Too Hot, Not Too Cold, June 20).

This is what we call the “goldilocks peso” – a steady peso that is not too hot and not too cold, which is what the BSP, the Philippine economy and the Philippine stock market prefer. The steady peso has been instrumental in attracting foreign flows to Philippine assets as global investors search for a safe haven in addition to the higher yield and growth potential.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending