Election day 2016

In last week’s article (see Philippine Presidential Elections and the Stock Market, 2 May 2016), we wrote about how the PSEi performed during the different Presidential terms. For this article, we will be showing the Philippine peso’s performance over the same timeframe. Incidentally, the peso depreciated sharply in the past weeks. In fact, the last 3 weeks have proven to be very volatile for all asset classes in the Philippines, with election uncertainty weighing on equities, bonds and the Philippine peso. Over this time period, the PSEi fell by 5% and is now below the 7,000 level while the peso fell by 2%, breaking 47. The cost of insuring our country’s debt also rose by 20 basis points, reflecting the nervousness of investors.

“The Punisher” rattles the market

Often called “The Punisher” for his hard stance against crime, Davao City Mayor Rodrigo Duterte has maintained a double digit lead in recent surveys, with more than 30% of respondents saying that they will vote for him in today’s Presidential elections. While Filipino voters seem to favour Duterte, recent mock elections among fund managers, trust officers, treasurers, and economists show them preferring Mar Roxas. The cautious sentiment over Duterte is shared by many foreign funds and analysts who have been unnerved by his controversial statements and lack of clarity on his economic agenda. See below quotes from foreign analysts as seen on Bloomberg and Reuters:

1. “A Duterte win could add to expectations of some deterioration in market sentiment initially because of his controversial comments.” – Hakan Aksoy, Pioneer Investment Management

2. “Philippine bond yields will likely rise in the near term with potential rise in risk premium ahead of May 9 and the election tally, which continues for a few weeks.” – Euben Paracuelles, Nomura

3. “If his policies fall short, it could derail the current sweet spot of high GDP growth/low inflation enjoyed by the Philippines in recent years. This could be reflected in a sell-off in PhP assets as a larger risk premium gets priced in.” - Eugene Yuming Leow, DBS Bank.

4. “Investors want to see a continuation of Aquino’s fiscal prudence and anti-corruption efforts. Near term, there could be market volatility surrounding the election.” – Vincent Tsui, Alliance Bernstein

5. “Duterte, on the other hand, has given little concrete plans apart from his tough stance on crime and the need to build industries and factories. His recent comments have also spurred a backlash from the international community after he has declared he is willing to sever ties with the US and Australia.” – Leong Jin Jing, Aberdeen Asset Management

6. “What Duterte has commented recently is not going to give a lot of comfort to foreign investors. All of the candidates want to encourage FDI, but there might be a risk that foreign investors would be cautious under Duterte. From a bondholder view, the other candidates might be better. In the near term, volatility of Philippine US dollar bonds might increase if he were to win the elections." – Joep Huntjens, NN Investment Partners

Presidential elections and the Philippine Peso

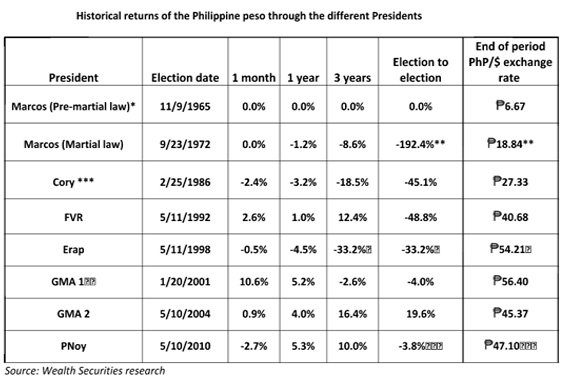

As we mentioned earlier, it wasn’t just the stock market that succumbed to election jitters, but the peso as well. From 46.05 in the middle of April, the peso now trades at more than 47 to the dollar, making it one of the worst performing currencies in Asia. Thus, not only are investors worried about stocks, but the peso as well. Thus, in this article, we will show you how the peso fared across the different Presidents. See the table below which is structured in a similar manner as the one in last week’s article.

* Peso was pegged for most of President Marcos’ term

** Until EDSA Revolution

*** Reckoning point is after the EDSA Revolution, not snap elections

? Only until end of term on January 20, 2001

?? Assumption into office after Erap’s impeachment, not an election period

??? As of closing on May 6, 2016

As can be seen in the table above, the Philippine peso weakened the most during the martial law years. From 6.7 to the US dollar in 1972, the peso reached 20/$ before time martial law ended in 1986. Since then, the peso continued down its weakening trajectory, albeit at a slower pace. Note the impact of the multiple coups and natural disasters in Cory’s term, the 1997 Asian Financial Crisis at the tail end of FVR’s term and the political crisis that ended Erap’s term. After all these were said and done, the peso had fallen to as low as 56/$ before recovering.

Peso bottoms

The peso began to strengthen during GMA’s 2nd term. In fact, not only did we expect this, but if one reads Chapter 6 of the book, Opportunity of a Lifetime, one will see the bold call we made on the peso. We wrote that our currency had finally reached bottom at 56, much to the disbelief of many of our investors and readers whose mindset has been to buy dollars every time they have savings. However, as can be seen in the table, the peso’s weakening trend did end in the 2nd term of GMA and has continued to strengthen since then.

Fiscal reform is crucial

What led us to conclude that the peso had bottomed was the passage of the unpopular but much needed EVAT bill. As mentioned in Chapter 5 of the book, the passage of EVAT set the country on a path of sustainable growth and laid the foundation for future fiscal reforms. Thus, it is crucial that the next government maintain the current fiscal discipline and continue to implement sound fiscal policies. Otherwise, our country may fall behind and become the “Sick Man of Asia” once again.

Foreign analysts have highlighted the need for more clarity on Duterte’s economic agenda, as he is the likely winner in today’s elections. As Soo Hai Lim of Baring Asset Management said, “I hope when he does become president he’ll be more grounded and less controversial. His platform to reduce crime is good but at the end of the day investors need somebody who could implement policies that are generally good for the investment climate.”

Not a smart aleck

Another factor contributing to the nervousness in markets is Duterte’s coyness on economics. Until now, the frontrunner has yet to identify who his Cabinet members and economic advisers will be. This is contrary to how other Presidential candidates have named their economic team early on during the campaign. Fortunately, it looks like Duterte will heed the advice of the business community. In a televised forum last week, he had this to say:

“Why would I attempt to be a smart aleck? If I get to be president, I would employ the economic minds of the country, offer them a higher salary. If they weren’t impressed with me, I’m sorry.”

As we said in last week’s article, the country does not lack brilliant economists and technocrats who are willing to serve. We hope that whoever wins the Presidency will utilize these people for the betterment of our nation.

Chance for “The Punisher” to shine

If Duterte wins, this is his chance to shine and calm the nervous market. He should take the opportunity to lay out his economic agenda and appoint credible people to his Cabinet and government. We are certain that he has competent economic advisers around him, so all he has to do is show us who they are and explain how he plans to bring the country forward. The Punisher should tone down his fiery rhetoric and instead take a conciliatory tone to unite the country after this polarizing election season.

With stocks, bonds and the peso rattled by election jitters, some analysts have noted that they see an opportunity to buy amidst all this risk. Gary Yau of Credit Agricole stated that “while we understand the anxiety of society and the market given the uncertainty a Duterte win will bring, we would be wary of any over-reaction. Fundamentally the Philippines remains one of the healthiest economies in the region, with growth of around 6%.” If the President elect is able to assure investors that concerns over his controversial campaign statements and lack of a clear economic platform are overblown, then after elections are over and done with, fundamentals will eventually prevail.

Vote wisely

With tens of millions of our countrymen trooping to polling precincts today, we fervently hope that the elections will be peaceful, orderly and without incident. With an unprecedented 3 lead changes in the surveys, this election has proven to be very volatile and deeply contested. Thus, with election day finally upon us, we urge or countrymen to vote wisely. Vote for the best President and the best Vice President. Vote for the one who will bring the most benefit to our stock market, economy and country.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending