The 1986 EDSA revolution and the Phl stock market

Last week, our country celebrated the 30th anniversary of the 1986 EDSA revolution. For some, the EDSA revolt ended an authoritarian rule and restored democracy. For others, 1986 marked the start of our country’s multi-decade structural transformation. Our country’s population has a median age of 23.4 years. Hence, most of our country’s youth were still very young or were not even born yet when the EDSA revolution took place. There is also sparse economic and financial data available. These are probably some reasons why many do not know or remember what happened to our country and our stock market during those times. In this article, we provide a recap of how financial and economic conditions were during those times and the effect of People Power on our country’s stock market.

A bankrupt economy

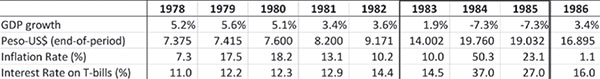

Looking at the available economic and financial data clearly shows that our country went through very agonizing times in the years leading up to the EDSA revolution. In the table below, we show our economy went on reverse mode as GDP growth dropped 7.3 percent in the years 1984 and 1985. Moreover, the peso depreciated by more than 150 percent in five years (1981 to 1985). Interest rates also skyrocketed in 1984 and 1985, a clear evidence of tight and stressful financial conditions during those times.

Financial and economic Indicators – 1978 to 1986

Sources: World Bank, Bloomberg, Philippine Institute for Development Studies

Jobo bills – interest rates at 40 percent

In 1983, the Philippine government was unable to meet interest payments on its foreign-currency debt, prompting it to ask for a moratorium on payments. The government received an emergency bailout from the International Monetary Fund (IMF) in exchange for strict conditions to devalue the peso and tighten domestic credit. As financial and economic conditions turned from bad to worse, more and more creditors refused to lend to the Philippine government. The country also suffered from massive capital flight. These prompted the central bank to issue the Jobo bills (named after then Central Bank Governor Jose “Jobo” Fernandez). These were central bank bills which fetched astronomical yields of 40 percent.

Crowding-out of private sector lending

Local banks stuffed their balance sheets with Jobo bills, as these offered exorbitant and extremely attractive yields. This was a time when heavy government borrowing absorbed the local banking sector’s available lending capacity, thereby crowding-out lending to the private sector. Consequently, the banks were left with no money for private sector lending. In turn, business activity eventually grinded to a halt, resulting in the pronounced economic downturn that was witnessed in 1984 and 1985.

115 percent peso depreciation in two years

The table above shows the peso depreciated against the US dollar by 115 percent in two years (1983 to 1984). We note, however, this is the reference or official rate. The black market rate was much higher for the peso as it was extremely difficult to get hold of US dollars. These were signs of extremely tight financial conditions during those times.

In present terms, the peso’s move from 1983 to 1984 is equivalent to the peso depreciating from the current level of 47.50 to 102.30 in just two years.

A much different stock market

The stock market then was much different from the one we have now. There was no Philippine Stock Exchange (PSE) yet. Instead, the country had two exchanges – the Manila Stock Exchange and the Makati Stock Exchange. There was also no PSE Index yet. Instead, there were three sector indices – the commercial and industrial index, the mining index and the oil index. Most of the trading then was in mining and oil stocks. In the years leading up to the EDSA revolution, value traded was extremely low in the stock market. On most days, value traded was less than a million pesos per day. In fact, many traders and brokers were just playing chess and backgammon in the trading floor during trading hours. Understandably, there was no heavy participation from foreign investors, as our country was grappling with a massive contraction in economic activity, exorbitantly high interest rates and a sharply depreciating currency.

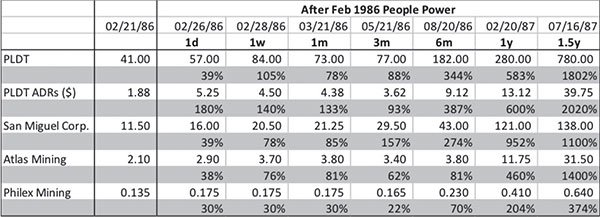

A jolt of life for the market

The EDSA revolution not only brought political and economic change but also provided a much needed jolt for the stock market. As we show in the table below, local stocks surged in the weeks and months following the People Power revolt. There was also increased stock market activity, as the change in government and the restoration of democracy served as catalysts for an economic turnaround. The Philippines became the best performing stock market in the world in the 18 months that followed the 1986 EDSA revolution. However, the post-EDSA bull run was temporarily halted by the coup attempts in 1987 and 1989.

Performance of stocks after the 1986 EDSA revolution

Stock prices are unadjusted for stock splits and stock dividends

Sources: Technistock, Business Day, Rizal Library – ADMU

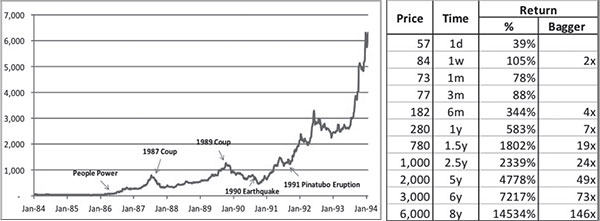

PLDT’s spectacular bull run

Below, we show PLDT’s long-term chart from 1984 to 1994. Note the prices shown are not adjusted for stock splits and stock dividends. Since there was no PSE Index yet during those times and most of the trading then was in oil and mining stocks, PLDT was considered as a proxy for the stock market. After being in the doldrums for many years, PLDT’s stock price surged after the EDSA revolution. If one bought PLDT shares on Feb. 21, 1986 (last trading day prior to the EDSA revolution), his investment would have increased by 39 percent after one day, doubled in one week and quadrupled in six months. Moreover, his investment would have grown 7x in one year, 49x in five years and 146x in eight years.

PLDT – price chart and price performance – 1984 to 1994

Stock prices are unadjusted for stock splits and stock dividends

Sources: Technistock, Business Day, Rizal Library – ADMU

The birth of the Phl secular bull market

At Philequity, we always look for opportunities that have the potential to generate outsized returns. Our book is entitled “Opportunity of a Lifetime” as it described the opportunity that arose after the 2008-2009 financial crisis. What we witnessed in the stock market after the EDSA revolution was a rare opportunity of a generation to participate in the birth of the Philippine secular bull market (see pages 69 to 75 and Chapter 7 of our book “Opportunity of a Lifetime”).

Learning from history

The lost years of the early 1980s can be seen thru economic numbers and other financial data. We believe our country’s experiences during those times can serve as important lessons not only for politicians, historians, economists, businessmen and stock market investors, but also for the common Filipino. There is much to be learned from looking back and studying the lessons of the past. History provides us with precedents that can guide us in our present and future decisions in economics, politics, governance, fiscal management and stock market investing. As the popular saying goes, “Those who cannot remember and learn from the past are condemned to repeat it.”

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending