GDP – A matter of perspective

Last Thursday, traders and economists counted down the seconds to 10 a.m. – the time when the Philippines’ Q3 GDP growth would be revealed. Coming out at six percent, this was a tad below consensus forecast of 6.3 percent, but higher than the five percent and 5.8 percent (adjusted) growth in Q1 and Q2, respectively.

Much ado about growth

While a below forecast number is hardly something to celebrate, investors breathed a sigh of relief as our country’s growth rate returned to the six percent level. This single economic figure is so important to market participants such that disappointment over the Q1 GDP figure, which was way below forecast, caused the Philippine stock market’s first major correction this year (see Disappointment, June 1, 2015).

Behind the numbers

Given that GDP is quantifiable, it is easy to get behind the numbers and figure out what makes it rise or fall. The sharp improvement in the Philippines’ 3rd quarter GDP growth lies in what dragged it in the first place – government expenditure. From modest growth in the 2nd quarter of 3.9 percent, it accelerated to 17.4 percent in the 3rd quarter. According to NEDA director-general Arsenio Balisacan, this “shows the government is proving successful in its efforts to overcome the spending bottlenecks that hampered growth in the first semester.” Domestic consumption, which accounts for 70 percent of our GDP, also grew by 6.3 percent. However, economic growth was tempered by weakness in exports and a slowdown in manufacturing. Agricultural output was also low due to the effects of El Niño.

Still among the fastest

Despite below forecast growth, Balisacan notes the Philippines is the 3rd fastest growing Asian economy, behind only China (6.9 percent) and Vietnam (6.8 percent), with India yet to release its Q3 GDP growth figure. With low oil prices being a boon to us and a bane to our commodity-exporting neighbors, our country is clearly in better shape than our Asian counterparts. As for China, it is grappling with an economic slowdown, while Vietnam is taking a breather from years of high inflation. Thus, even though our country is just #3, our macroeconomic environment is much more stable than even our faster growing neighbors.

Sick man to bright star

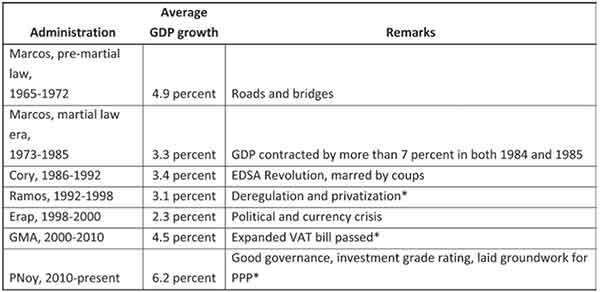

It is also important to note the Philippines is growing at a much faster clip than it used to. In fact, from 1992-2009, from the Ramos administration to the end of GMA’s term, the average annual GDP growth of the Philippines was 3.9 percent. Now, investors are demanding above-six percent growth, a far cry from the four percent growth we were accustomed to in the past decades. So far, average GDP growth in the current administration is 6.2 percent, a significant improvement over historical averages, as can be seen in the table below. Therefore, in spite of the weak growth earlier in the year, the Philippines is now growing faster. Thus, the description for the Philippines is no longer “sick man of Asia”, but “bright star in a dim sky.”

Average GDP growth across different administrations (1965-present)

*see Chapter 5 of Opportunity of a Lifetime, Fiscal Reform in the Philippines, pages 110-126

A table showing the Philippines’ annual GDP growth starting 1965 to 2014 will be available in Philequity’s website.

Bright star with a brighter tomorrow

Against a backdrop of slowing global growth, many research reports have also touted the Philippines as the bright star in Asia and emerging markets (see Best House in a Bad Neighborhood, Sept. 2, 2013). Growing BPO revenues, stable OFW remittances and strong domestic consumption have insulated us from the slowdown elsewhere, while low commodity prices continue to work in our favor and keep inflation low. Balisacan echoes this optimism when he said “the expected acceleration of growth in the last quarter of 2015 supports their optimism for continued growth in 2016.” With the coming quarters expected to be better, we have a brighter tomorrow to look forward to.

A matter of perspective

Whenever we compare things, like GDP in this case, it is ultimately a matter of perspective as it depends on your point of comparison. For instance:

1. If you compare our GDP growth to historical averages, 6 percent is excellent.

2. If you compare it to government targets, it would be disappointing because it is below the previous 7-8 percent GDP growth target

3. If you compare it to consensus forecasts, it is also slightly negative as it missed Q3 expectations by 0.3 percent

4. If you compare it to the growth in the region, it would be the 3rd fastest, clearly among the best

5. If you compare it to global growth, it would be enviable against a backdrop of slowing global growth and even recession in some countries

Half full

Just like how one views a glass as half empty or half full, one’s take on the recent GDP growth number is largely a matter of perspective. But based on our history and what is happening elsewhere in the world, it looks like the glass is more than half full. However, to maintain our upward growth trajectory, it is crucial this current administration’s good governance and pro-reform policies are continued and improved by the next government. More than being a matter of perspective, this is imperative.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending