A cloudy September

Ba de ya, say do you remember

Ba de ya, dancing in September

Ba de ya, never was a cloudy day

The lyrics above are from the refrain of the song “September” by Earth, Wind and Fire. Unfortunately, unlike this upbeat song, September 2015 was a month that traders would rather not remember. There was definitely no dancing for joy and it certainly was a very cloudy time for the stock market.

What is it with September?

Like the song above, there are so many other songs with “September” in the title. Examples of these are “See You in September” by the Happenings, “September in the Rain” by The Beatles, “September Morn” by Neil Diamond and “September Song” by Frank Sinatra. There are also songs without September in the title yet have a September theme, like “When Summer is Gone” by Gary Lewis & The Playboys, which people commonly mistake as “I’ll See You in September” because the song starts out with those words.

However, in contrast to the joyful and upbeat songs of September, statistics show that the stock market tends to be subdued and gloomy during this month.

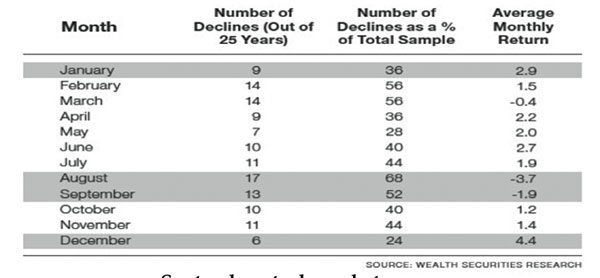

September – true to form

In the book “Opportunity of a Lifetime”, we dedicated Chapter 10 to Investor Education. We devoted a portion of the chapter to discuss seasons in the stock market. For instance, we noted that the ghost month is truly an unlucky month. We also showed how some months are better than others. The table below is taken from page 195 of the book and shows how August and September are the worst months for stocks, with an average return of -3.7 percent and -1.9 percent, respectively. Thus, this September has been true to form, albeit much more horrible.

September stock market woes

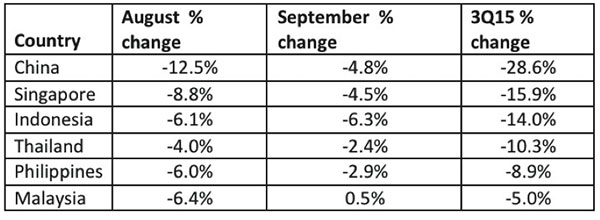

While August and September have been brutal for the Philippine stock market, our neighbors had it much worse. In a previous article (see Throwing the Baby Out With the Bath Water, Sept. 28, 2015), we wrote about why the Philippines is being sold down along with its more problematic neighbors. China’s growth slowdown also affects Asian countries more severely because of their proximity and trade linkages. See below a table showing the performance of the equity indices of China and the Asean 5 in August, September and the 3rd quarter of 2015.

September pain for Asean currencies

It was not just equities that had a savage month, but currencies as well. See below a table showing the performance of the Asean 5 currencies in August, September and the 3rd quarter of 2015. Note how the bulk of their depreciation against the US dollar this year occurred just in the last two months.

Worst 3rd quarter in years

As the 3rd quarter of 2015 came to a close last week, analysts scrambled to make sense of the carnage. Despite quarter-end window dressing, the MSCI All Country World Index, which is the weighted average of all stock markets in the world, had its steepest quarterly drop in 4 years, falling 6.6 percent. European indices also had their sharpest 3rd quarter descent since 2011, with corrections of between 7-12 percent in just three months.

However, equities were not the only victim of this brutal sell-off. Commodities and currencies fell precipitously as well. The Bloomberg Commodity Index logged a 16 percent drop in the 3rd quarter. At the same time, many emerging market currencies depreciated by double-digit percentages against the US dollar. If there is anything memorable about September 2015, it would be the savage sell-off across all asset classes.

Emerging markets – first annual net outflow in 27 years

One reason behind this sell-off is the sheer amount of money leaving emerging markets. According to the Institute of International Finance, emerging market investors will likely end the year with a total outflow of $540 billion from emerging markets. This would be the first annual net outflow since 1988 and comes during a commodity rout which has led to a sustained slowdown in emerging market growth.

Philippines least vulnerable, least exposed to external risks

Looking at the 2nd and 3rd tables above, it is important to note that although the Philippines is not immune from the sell-off, Philippine stocks and the Philippine peso are the clear outperformers in the region. In a report released last week, the S&P assessed the Philippines as the “least vulnerable” to capital outflows, unwinding of domestic credit and China’s growth slowdown. In a similar report, Fitch said that the Philippines is the “least exposed” to external risks. This explains why, despite a deteriorating growth outlook, the Philippines has been outperforming its neighboring countries.

Santa Claus is coming to town

We have seen that the performance in the 3rd quarter has been horrendous. Fortunately for market participants, Christmas season is coming. Based on our data, December is the strongest month of the year, with an average return of 4.4 percent and a 76 percent chance of being positive. Assuming statistics and probabilities run true to form, it looks like Santa Claus will come to town and rescue our stock market.

Wake me up when September ends

With one of the worst Septembers now behind us and filled with hope that the coming months will be rewarding for investors, we leave you with lyrics from the song “Wake Me Up When September Ends” by Green Day:

Here comes the rain again

Falling from the stars

Drenched in my pain again

Becoming who we are

As my memory rests

But never forgets what i lost

Wake me up when September ends.

* * *

Aside from Fully Booked and the Philequity office, our book, Opportunity of a Lifetime, is now available at selected branches of National Bookstore.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending