Philippine peso: A haven of stability

With slowing economies around the world, governments are worried about a double-dip recession and deflation, hence the coordinated action by central banks in previous years to stimulate through QE and low interest rates.

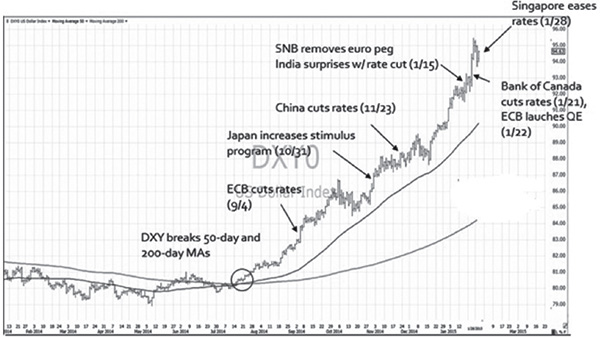

Divergent central bank policies

Since the 2nd half of 2014, however, central bank policies have started to diverge and economies recovered at different speeds. While the Fed is already expected to raise rates by mid-2015 as the US economy remains on track for solid growth, many countries continue to struggle with their respective economies and are still on the easing path. This effectively fueled the strong appreciation of the US dollar the past six months.

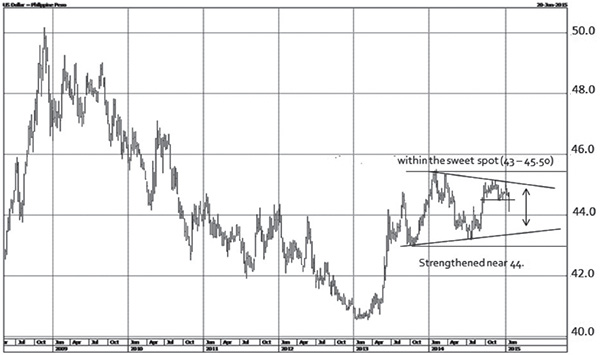

In the midst of this dollar bull-run, however, the peso has been a haven of stability, staying well within its “sweet spot” of 43 to 45.50 despite increasingly volatile swings in the currency markets.

Slowing economies, low interest rate regimes, looming currency war

The BOJ’s and the ECB’s move to stimulate their economies through QE and low interest rates has caused some analysts to speculate that a looming currency war may arise.

Central banks of South Korea, Thailand, Malaysia, China, fearful of their own economies slowing down, have responded by lowering their respective rates. Last month alone, India, Denmark, Switzerland, Egypt, Turkey, Canada Singapore and Russia have lowered policy rates. Meanwhile, the ECB launched its long-awaited massive QE program last month worth 1.1 trillion euros.

US dollar index (January 2014 – present)

Source: Stockcharts.co, Wealth Research

Expanding currency volatility

The divergent policy moves by the central banks, which have caused the dollar to strengthen, have resulted in increasing bouts of currency volatility. The past year alone, the euro lost 18 percent against the US dollar while the Japanese yen declined 12 percent. Meanwhile, the Russian ruble’s 85-percent plunge against the US dollar in one year and the Swiss franc’s 39-percent intraday rise against the euro are among the biggest currency moves in recent memory.

Peso remains steady

Amid volatile currency swings, however, the peso remains a haven of stability. In fact, the peso even appreciated 1.4 percent to 44.113 vs. the dollar for the month of January even as major currencies suffered its steepest monthly decline against the greenback in 2 ½ years.

A month ago, we were concerned with the risk that the peso might break above 45.50 as it traded near the upper range of its sweet spot. More so, when the Singapore dollar (previously the strongest ASEAN currency) completed a four-year topping formation against the US dollar. Today, that risk has greatly diminished as the peso appreciated back towards 44. A break of 44 will push the peso-dollar rate back to the next support level of 43.

Source: Technistock, Wealth Securities Research

Share placements

Strong portfolio investment inflows following a seasonally strong month of dollar remittances drove the peso higher last month. Foreign flows in January amounted to P22 billion or roughly $500 million according to the Philippine Stock Exchange (PSE). The bulk of this went to the Ayala Land Inc., First Gen Corp. and JG Summit Holdings which had share placements totaling $733 million.

Lower oil import bill = Lower dollar demand

The steeper-than-expected and sustained decline in oil and commodity prices is likewise favorable to the peso. Note that the benchmark Dubai crude, which has averaged $104.25/bbl the past four years, has fallen to $60/bbl in December 2014 and $50/bbl last month.

Since the country imports roughly 110 million barrels of oil per year, we stand to save potentially $6 billion if Dubai crude stays at 50. This also means that there will be $6 billion less demand for dollars due to the lower oil import bill.

A lower import bill would then translate to improved trade surplus, supporting the current account balances and FX reserves position, and resulting in a stronger peso.

Fed and other CBs may take action if strong US dollar becomes counter-productive

Given the sharp rise of the US dollar, the Fed and other central banks may find the dollar appreciating too fast too soon. Already, the negative effects of a strong dollar are affecting the earnings of companies such as P&G, Microsoft and Pfizer which have expanded aggressively overseas. The strong US dollar is also exacerbating the decline in oil and commodity prices which has devastating effects to economies dependent on commodity exports.

The Fed and other CBs may intervene and take action if the strong dollar becomes counter-productive to the stability of the global economy. If this happens, we may see a pullback in the US dollar resulting in an even stronger peso.

PSEi and peso: strongest performer in January

The unprecedented drop in oil prices and the resilient growth in the Philippine economy has led to the peso and the PSE index becoming one of the best performers for the month of January. The PSE index is now at a new all-time high of 7,689.91. This is also much like what happened to India whose currency, the rupee, appreciated last month while the Sensex index hit new record highs.

In our next article, we will discuss the reasons why we remain bullish on Philippine equities as well as our strategy and forecasts for 2015.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending