Did you know?

1. Did you know that, starting today, the Philippines will only have three trading days left for the year?

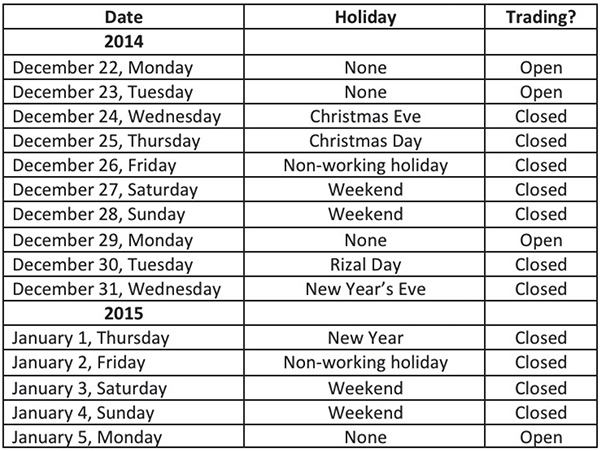

For the remainder of the year, Dec. 22, 23 and 29 are the only remaining trading days. After that, trading will resume on Jan. 5 next year. All other days either land on holidays or have been declared to be non-working holidays. See below a table showing the holidays and trading schedule for the next two weeks.

2. Did you know that the Philippines has one of the longest Christmas holidays?

Based on the table above, if a person takes a leave on Monday, Dec. 29, he will be able to enjoy 12 straight days of vacation from Dec. 24 to Jan. 4. This may well be one of the longest Christmas breaks in the world.

3. Did you know that if you buy today, you only have to pay after two weeks?

Thanks to this long Christmas holiday, anyone who buys stocks today will only have to pay two weeks from now. Note that, after today, there are only two working days left in the year (see table above). With payment being made on a T+3 basis, the due date would actually be on Jan. 5 next year, hence the two-week window before payment is due.

4. Did you know that in the US there is trading on some holidays?

Unlike the Philippines, the US stock markets are open for trading on some national holidays. For instance, the US has trading on Columbus Day and Veterans’ Day. On these days, banks are closed, there is no settlement and clearing, but trading continues. Settlement is done on a T+4 basis instead of T+3. The US and other major stock markets are open on Christmas Eve, Dec. 24, and New Year’s Eve, Dec. 31. In the past, when the Manila and Makati stock exchanges were still separate, there was trading on some holidays. In these situations, settlement was done on a one day delayed basis instead. With the latter part of December as being the strongest, it is unfortunate that the Philippines may not be able to fully participate in this Santa Claus rally. Thus, the PSE Board of Directors may have a special meeting to evaluate if Dec. 26 and Jan. 2 will be declared as trading days.

5. Did you know the word “patient” can send the Dow index up by more than 400 points in one day?

Last Wednesday, the Fed said they will “be patient in beginning to normalize the stance of monetary policy.” The keyword here is “patient”. Previously, the Fed used the phrase “considerable time”. By using the word “patient”, Federal Reserve Chairman Janet Yellen signalled that there will only be rate hikes if the economy is strong enough and the economic data warrants it. She also said that inflation still runs below two percent, therefore, normalization of interest rates may be delayed. With oil prices remaining low, this is a distinct possibility. With the word “patient” being music to every trader’s ears, the Dow index soared 421 points last Thursday. Patience is indeed a virtue.

6. Did you know that US stocks had their strongest three-day rally since 2011?

The move of US markets from Wednesday to Friday last week has proven to be the strongest rally since 2011. The Dow index rose 4.3 percent while the S&P 500 climbed 5.0 percent in three days, erasing its recent drop. In fact, the Dow index is just five points away from its all-time closing high. The Philippines also benefitted from this, with the PSEi rising 3.5 perdent from the lows set last week.

7. Did you know oil prices have fallen 50 percent in the past six months?

Our readers may have noticed that gasoline prices have started falling. This is because oil prices have now fallen 50 percent since June, with Brent crude now at $61/barrel. Oil prices are now at levels not seen since the world emerged from the 2008 Financial Crisis (see Plunging Oil Prices: The Winners and the Losers, Dec. 15, 2014). The losers, such as oil-producing countries, have seen their economies pressured by dwindling revenues. Stock prices of energy and oil-related companies also dropped precipitously. Fortunately, the Philippines is one of the big winners, if not the biggest winner, in this low oil environment.

8. Did you know that the Russian ruble has lost more than half its value?

Unfortunately for Russia, it is one of the biggest losers of plunging oil prices. Coupled with economic sanctions from the West, the Russian ruble had fallen from 32 to as much as 79 to the dollar, with the bulk of the drop occurring in the last four months. To stem this, Russia’s central bank brought benchmark interest rates to 17 percent and used its foreign exchange reserves to directly intervene in the market. Since then, the ruble has stabilized at 60 to the dollar. With this sharp depreciation in the ruble, Russia’s billionaires have lost half of their net worth, not including the drop in stock prices in the past months.

9. Did you know that the #1 problem of 2014 is this year’s best performer?

At the start of the year, fund managers were polled and were asked what their biggest concern for 2014 will be. The #1 concern of most fund managers is China. Many analysts were expecting a China hard landing this year, with growth decelerating so sharply that it will drag down the rest of the world. However, despite all this bearish reports and forecasts, the opposite happened as the Shanghai Composite rose 47 percent for the year. In fact, the Chinese stock market is the strongest in Asia and the world, defying consensus expectations. If China continues to go up, we expect it to bring global equity indices higher along with it, including the Philippines.

10. Did you know that investing your ang pao every Christmas can make you a millionaire?

As children, we tend to receive gifts from our parents, grandparents, uncles and aunties. Some come in the form of toys, books or cash in little red envelopes (ang pao in Chinese). If one had invested these cash gifts instead of spending them, one could have accumulated a small fortune by now. Our backtesting shows that P6,000 invested in Philequity every Christmas starting 1994 would be worth P1.1 million as of last Friday.

11. Did you know that an investment of P5,000 per month in Philequity starting end-1994 is now worth more than P10 million?

If one invested P5,000 every month in the Philequity Fund for the past 20 years, one will have a small fortune of P10.2 million by now. This is a testament to the power of saving money, the power of investing in a well-managed equity fund and the power of compounding.

Teaching your child how to invest starting at a young age may well be your greatest Christmas gift to him. However, before one can invest, one must first learn how to save. So instead of buying toys and electronic gadgets, teach your children to save and invest part of their ang pao. In time, they will have a small fortune to call their own.

Have a Merry Christmas and a Prosperous New Year!

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending