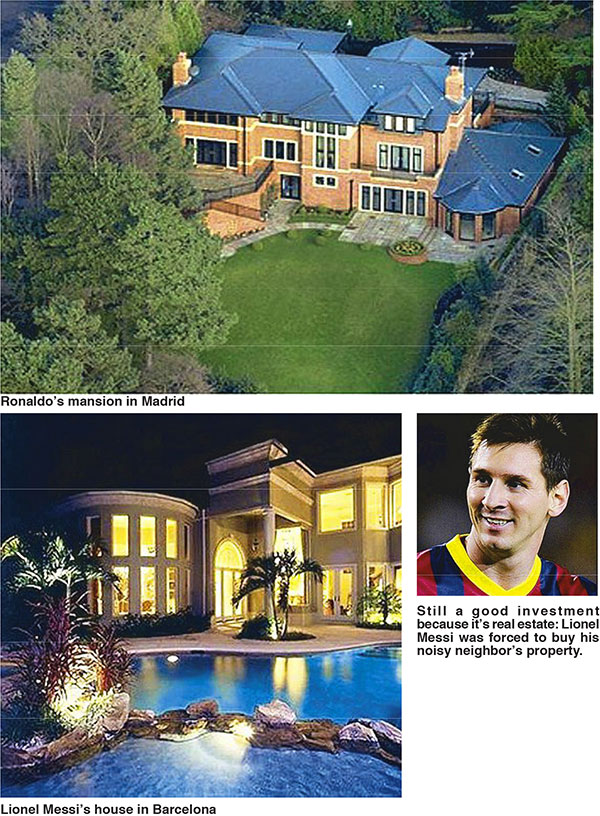

Invest in real estate like World Cup stars Ronaldo & Messi

I would give a thousand furlongs of sea for an acre of barren ground. — William Shakespeare

It’s tangible, it’s solid, it’s beautiful. It’s artistic, from my standpoint, and I just love real estate. —Donald Trump

Now that the world’s most popular sport of football is grabbing global attention with the exciting World Cup in Brazil, I encourage us to emulate the investments of soccer’s two biggest stars, but not their luxurious, jet-setting lifestyles.

Like other busy professionals who are not entrepreneurs or businesspeople, these two soccer superstars — Cristiano Ronaldo and Lionel Messi — have wisely parked part of their huge earnings in real estate.

THE 3 RULES OF CHOOSING REAL ESTATE INVESTMENTS

By the way, I don’t know who originally said this, but I recall hearing these realty investment guidelines from the late property entrepreneur Tan Yu: “There are three most important considerations when buying or investing in real estate, whether big or small: No. 1 is location, No. 2 is location, No. 3 is location!”

So how wealthy are the stars of the world’s most popular sport? I admire the inspiring football prowess of Portuguese Ronaldo and Argentinian Messi, who are now estimated to be the wealthiest football athletes, with Ronaldo reportedly having a fortune of £122 million or P9.1 billion, and with Messi a close second at £120.5 million or P8.99 billion.

In May 2014, Forbes magazine ranked Ronaldo as No. 1 among the world’s highest-paid football players with an income of $73 million from salaries, bonuses and off-field earnings like celebrity endorsements for the previous 12 months. Ranked No. 2 is Messi with combined earnings of $65 million in the previous 12 months.

In 2009, Ronaldo was reported to have quietly become an astute real estate investor by buying an £8 million luxury hotel on the Portuguese island of Porto Santo near his hometown of Madeira.

At that time, Ronaldo had already purchased four houses, which included a villa and a flat in Lisbon City. Other real estate holdings of his included a property in Madeira, a £4 million mansion in Cheshire and another £6 million property in Portugal. Was Ronaldo emulating British football star and savvy realty investor Robbie Fowler?

Although I equally admire the football talents of Lionel Messi, I’m disappointed there’s only one media report of his investing in real estate in recent years. Last year, due to Messi’s neighbors bothering him, he just bought their house in the exclusive suburb of Spain’s Barcelona City for the sake of peace and quiet, but this may yet prove to be a profitable investment.

The story is that the owners of the house next to Messi’s, located in Castelldefels, were remodeling it but ran out of money and asked him to buy it. Messi turned down the offer. This neighbor then decided to lease out rooms in the house, but the renters were very noisy and were also spying on the football star.

The irate Messi first reacted by constructing a huge dividing wall between the two properties. However, this wall violated certain zoning laws and the neighbors threatened a lawsuit, so, through his lawyers, Messi agreed to his neighbors’ demands and just bought their house.

WHY INVESTING IN REAL ESTATE IS BETTER THAN CARS, BAGS & GADGETS

Ronaldo loves luxury cars. He reportedly owns a US$300,000 Lamborghini Aventador; he crashed his $320,000 Ferrari in Manchester five years ago. His luxury car collection reportedly includes such brands as Bentley, Porsche and Mercedes.

I am not against luxury cars if one can afford to buy and maintain them, or even luxury toys like watches and bags, but let us emulate Ronaldo’s wise moves in real estate investments.

Why is real estate preferable over luxury toys?

Value appreciation — Cars depreciate in value and do not generate income, but good real estate in nice locations can appreciate continuously in market values and can also yield good rental income.

Ideal loan collateral — For those in need of cash in the future, real estate is also ideal collateral for bank loans.

Stability — Unlike investing money in the stock market, real estate values are generally more stable and less prone to price fluctuations. Even in cases of property bubbles — too-high prices and an excessive supply of homes like condominium units — the up and down movements of prices are also not as abrupt as in other investment options.

Limited supply — Except for land reclamation or the conversion of farms into subdivisions, prime real estate properties are usually limited in supply.

Real estate is not easy to fritter away. I know of not a few first-generation entrepreneurs or creators of new wealth who are worried that their possibly less-driven, less entrepreneurial or less talented kids and grandchildren might fritter away inherited wealth, so these elders would buy lands and even buildings with rental incomes to prevent future dissipation of wealth. Land, houses or buildings are not very easy to just liquidate and sell off for cash, unlike money in the bank, which can so easily be withdrawn via ATMs.

Realty is more recession-proof. During economic hard times or uncertainties when nervous investors try to invest in foreign currencies and even precious metals, real estate properties are also often considered similar in being a safer investment option.

Tax benefits for home loans — Some investors find using home loans beneficial for tax deduction purposes. Consult experts for details.

Realty is good as forced savings. For many non-businesspeople like Ronaldo and Messi, it is not easy to acquire the discipline of regularly saving up earnings. What better or easier means to force ourselves to save up part of our income monthly than by purchasing real estate, either through amortization payments or through bank loans? Do not forget to use the now well-managed Pag-Ibig Fund to buy your home.

Realty can give positive cash flow. If done wisely, real estate investments can yield regular rental income, which will give us long-term, predictable positive cash flow.

Happiness — Ownership of one’s own home seems to provide human beings with certain intangible, aesthetic and psychological benefits, which contribute to our overall efficiency as either professionals or businesspeople. Investing in one’s own home gives us the highest profit in terms of personal happiness.

* * *

Congratulations to low-key “rags-to-riches” realty billionaire Jose “Jerry” Acuzar of New San Jose Builders on his eldest child Jet Acuzar marrying Manila’s 5th district topnotcher, Councilor Ali Atienza, who’s the youngest son of Buhay Partylist Congressman Lito Atienza and wife Beng Ilagan Atienza. The wedding was held at the Acuzar family’s unique 400-hectare Las Casas Filipinas de Acuzar in Bagac, Bataan province.

Among the godparents were House Speaker Sonny Belmonte, BDO boss Tessie Sy-Coson (whose brother, Hans Sy of SM, also attended), Acuzar’s brother-in-law, Executive Secretary Pacquito Ochoa Jr., Iglesia ni Cristo executive minister Eduardo Manalo and wife Lynn, INC general auditor Jun Santos and wife Annie, former Vice President Noli De Castro, entrepreneur Jack Lam and Julie Rose Defensor.

There are talks that Vice President Jojo Binay and ex-President Joseph Estrada might draft former three-term Manila Mayor Lito Atienza to run for senator in 2016.

* * *

Thanks for your feedback! E-mail willsoonflourish@gmail.com or follow WilsonLeeFlores on Instagram, Twitter, Facebook and http://willsoonflourish.blogspot.com/.